ETHAX

Making blockchain trading accessible through **automated strategies**... **ETHAX**

Project Overview

Problem:

Trading platforms overwhelm new users with complex charts, indicators, and jargon. Inexperienced traders want to invest but don't want to learn the intricacies of trading.

What I did:

- Competitive research & reference gathering

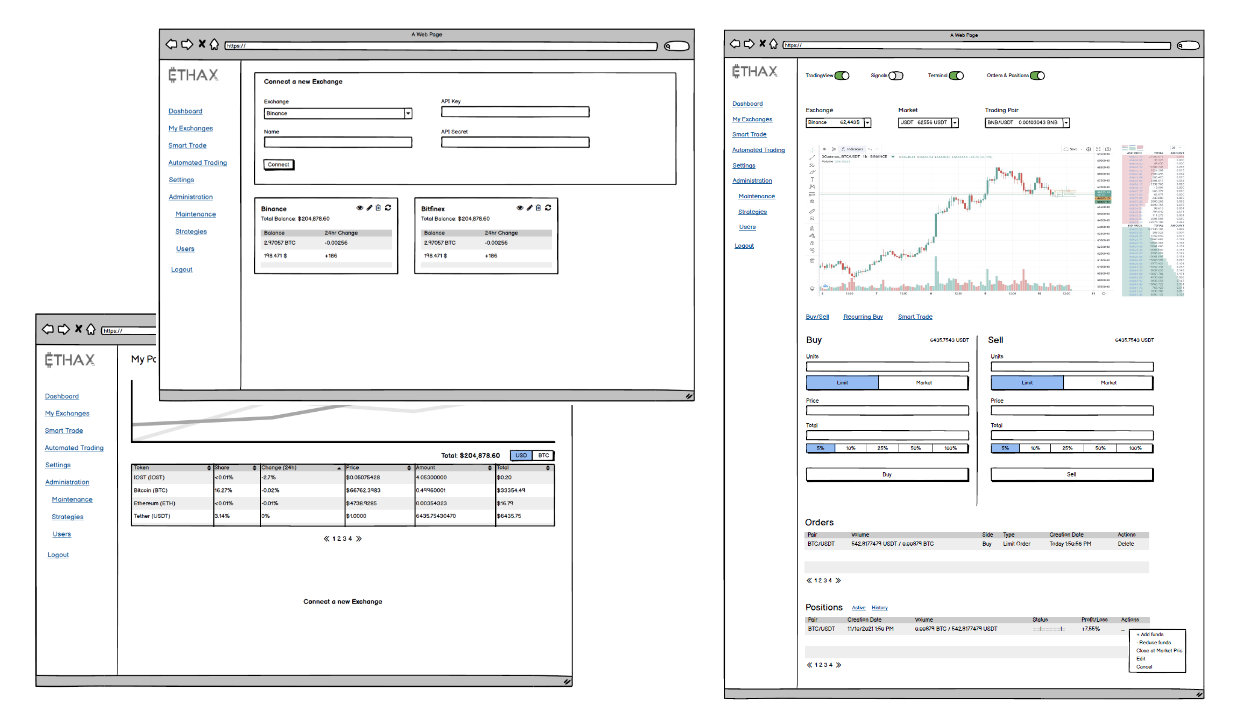

- Information architecture

- Wireframing & prototyping

- UI design for dashboard, strategies, and portfolio

TL;DR

- Challenge: Make blockchain trading accessible to users who don’t want to learn the complexities of trading

- Scope: Research, wireframing, and prototyping as Lead UX Designer (6-month project)

- Approach: Pre-built automated strategies that let users invest without manual trading

- Outcome: Successfully launched trading app

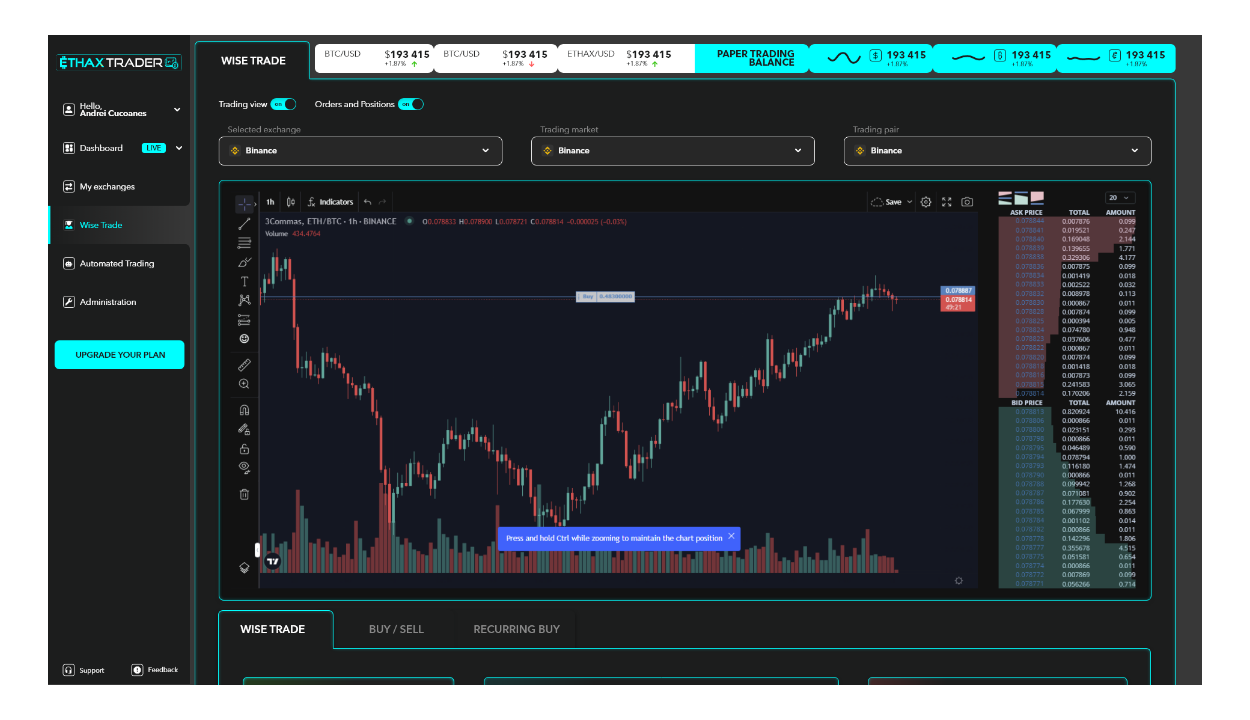

Trading platforms are usually overwhelming. Charts, candlesticks, indicators, order books - it’s a lot to process, especially for someone just starting out. But experienced traders need that information. Every data point can inform a strategy.

When ETHAX approached me, they had a blockchain trading platform with the mechanics mostly in place. The challenge wasn’t technical - it was experiential. How do you make a trading app that works for both experienced traders AND complete beginners?

I joined as the Lead UX Designer for a 6-month engagement. My focus was architecture and user interface - turning the existing mechanics into an experience that wouldn’t scare away newcomers while still serving serious traders.

The Research Phase

Before touching wireframes, I needed to understand what we were building against. I researched similar trading apps and crypto platforms to establish reference points.

The findings were shared with both the client and the development team. Getting alignment early meant fewer surprises later.

The key insight:

New traders don’t want to understand the intricacies of trading. They want to trust a system to do it for them.

This wasn’t about dumbing things down. It was about offering a different path - one where users could participate in trading without becoming traders themselves.

The main reference here was 3Commas.io, also competition.

The Solution: Automated Strategies

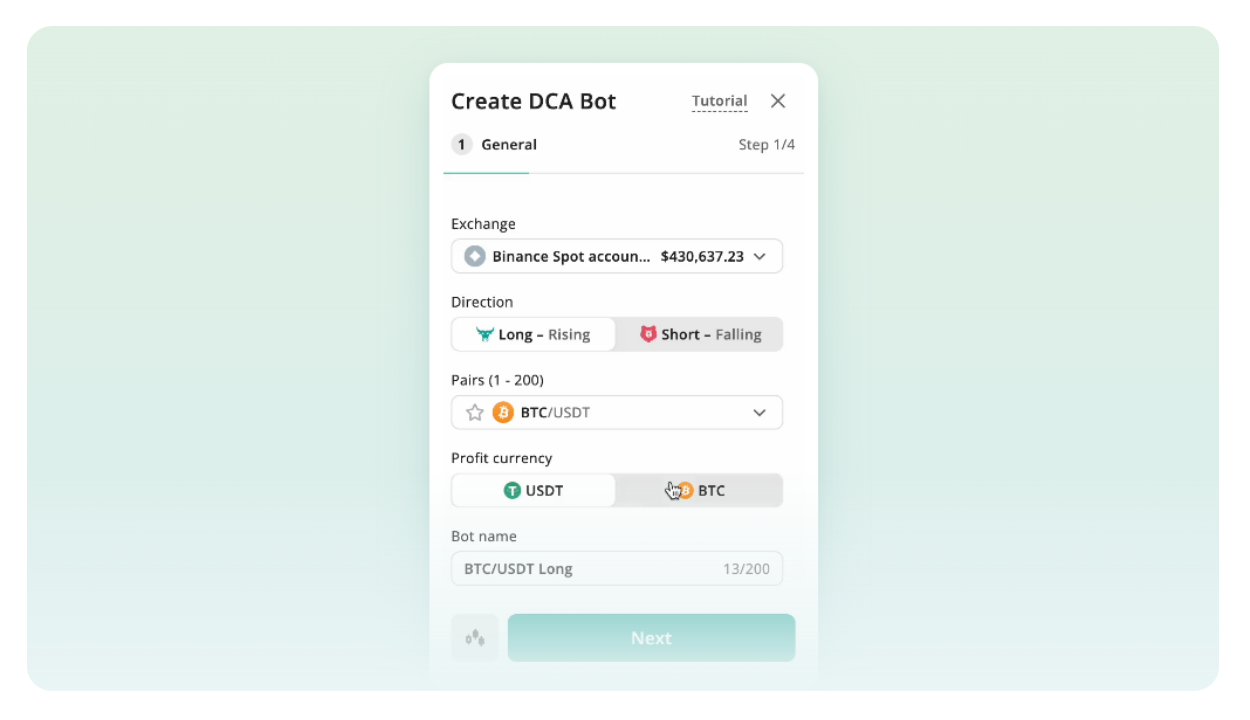

The answer was pre-built automated strategies.

Instead of asking users to read charts and make decisions, we let them choose a strategy that matched their risk tolerance and goals. The system handles the actual trading.

Think of it like choosing a playlist instead of picking individual songs. You decide the “mood”, the algorithm does the rest.

For experienced users, the full trading interface remained available. But for beginners, the strategies became the primary way to participate.

This approach solved the core tension:

- Beginners get a simple entry point, pick a strategy, fund it, let it do it’s thing

- Experienced traders still have access to all the data and manual controls they need

- The platform serves both audiences without compromising either experience

Architecture: Dashboard, Strategies, Portfolio

The app centered around three core areas:

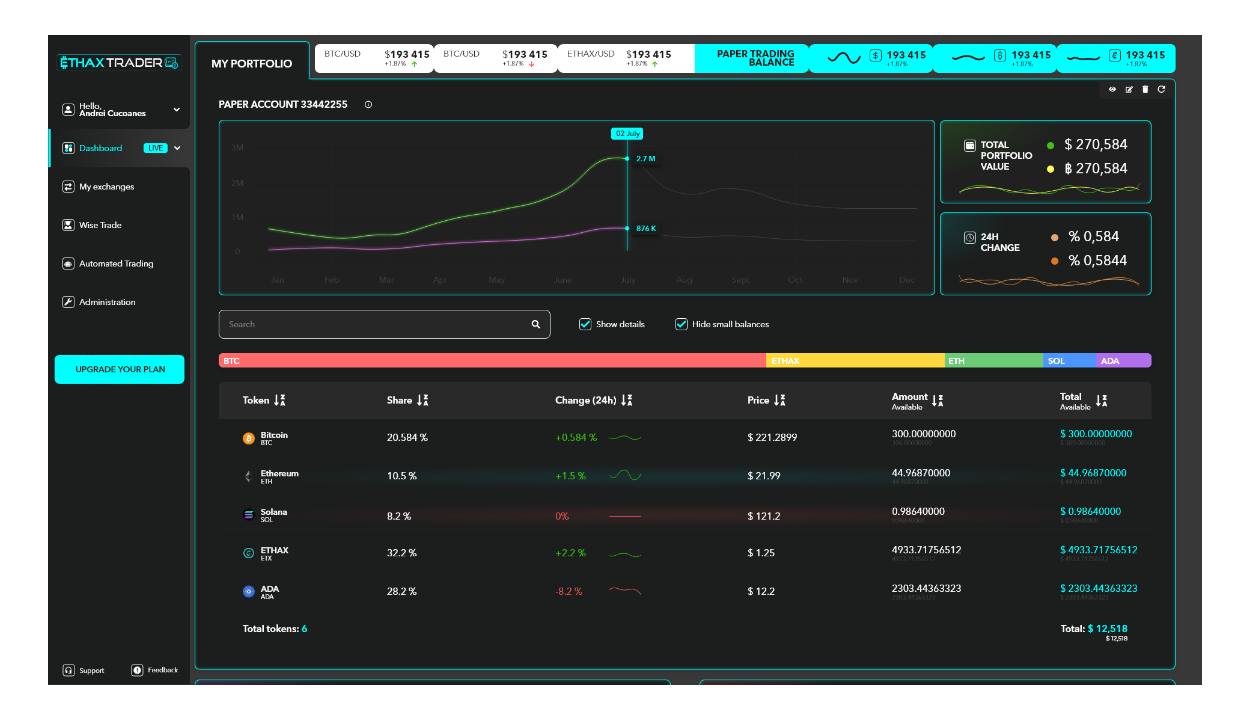

Dashboard The home base. Portfolio overview, active strategies, and key metrics at a glance.

Strategies Where users browse and select automated trading strategies. Each strategy shows its approach and risk level.

Portfolio Detailed view of holdings, transaction history, and performance over time.

The information hierarchy was critical. We had to show enough data to build trust without overwhelming new users.

UI Design

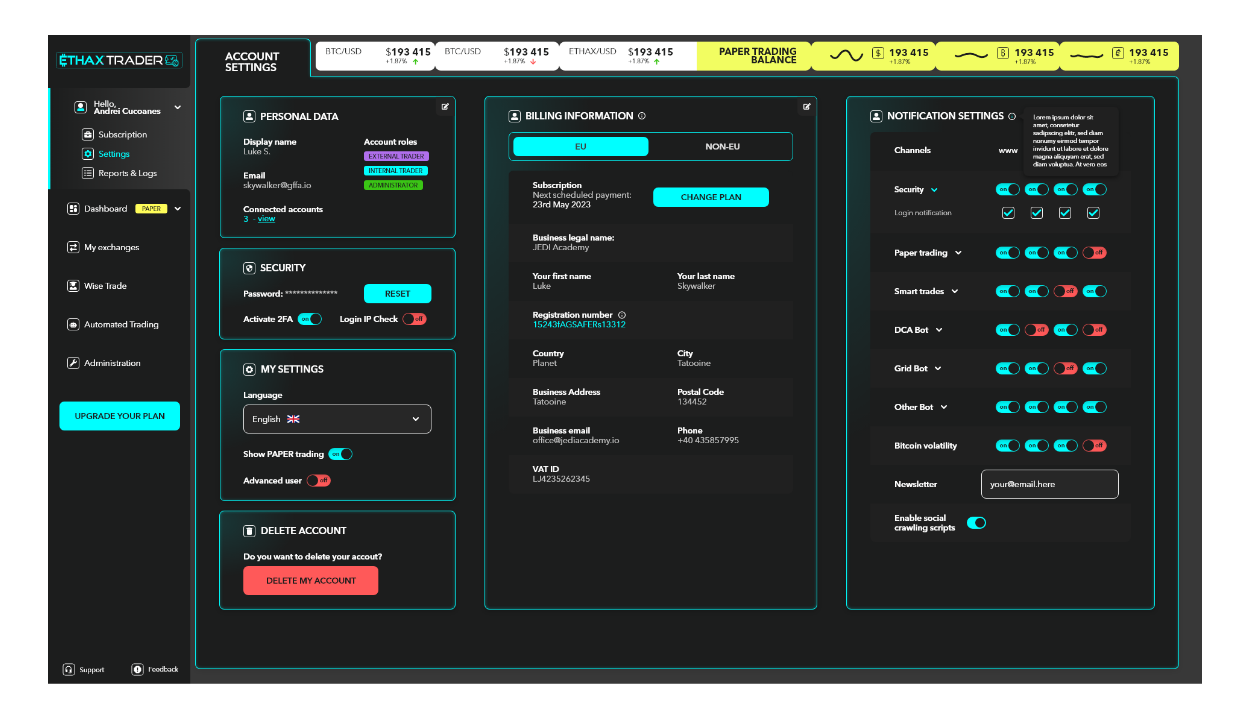

The visual design needed to walk a line: professional enough to feel trustworthy with money, but approachable enough not to intimidate.

Trading apps often default to dark themes with neon accents, sort of the “hacker aesthetic.” So I kept it in that register but tried to bring some clear typography, logical groupings, and breathing room between elements.

Key design decisions:

- Progressive disclosure - Advanced options exist but don’t clutter the primary view

- Clear visual hierarchy - The most important information is immediately visible

- Consistent patterns - Similar actions look similar across the app

Outcome

The platform launched successfully. The automated strategies provided the accessible entry point we designed for, while the full trading capabilities remained available for users who wanted more control.

A trading app that works for people who don’t want to be traders.

Shall we collaborate?

Either way, let's start with a short meeting so you get to know me even better and I you.

Let's start with "Hello there!"